Fee Remission and Financial Aid

Tuition Fees

Tuition fee of 2023/24 school year for primary school classes is HK$70,700 (P1) and HK$66,600 (P2-P6).

Tuition fee of 2023/24 school year for secondary school classes is HK$72,400 (S1), HK$68,100 (S2-S4, S5-S6 DSE classes) and HK$102,000 for International Baccalaureate Diploma Programme (IBDP) classes.

Adequate Support for Students with Financial Needs

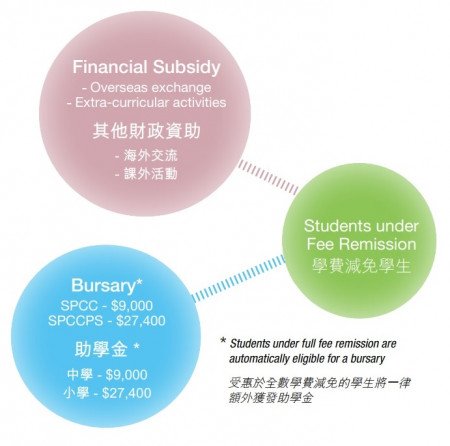

Bursary and financial aid are readily available to students with financial needs including recipients of Government SFAA and CSSA to ensure adequate support for their school life and learning opportunities at SPCC.

- Students under full fee remission are automatically eligible for a bursary (up to $9,000 for secondary students; up to $47,600 for primary students) to help cover their expenses on:

- textbooks

- school meals

- uniform

- school bus**

- Students under fee remission are also entitled to financial subsidy for overseas exchange and a range of extra-curricular activities.

** School bus expenses are only applicable to primary students

Fee Remission Scheme

Brochure on Fee Remission Scheme | Fee Remission Calculator | Worked Examples

We are determined that no qualified students should be deprived of the opportunity to study at SPCC due to financial hardship. Our Fee Remission Scheme is quota free and among the most generous in town. A child from a family whose family disposable income (after deducting the home rental or mortgage repayment, etc) is not higher than the Benchmark Disposable Income (BDI) will qualify for a 100% fee remission.

At present, the BDI for a family of four is set at $368,000 a year. In other words, families with an annual disposable income of no more than $368,000 will enjoy a 100% fee remission. Those with an annual disposable income of no more than $858,600 are still eligible for fee remission. Please refer to the table below.

|

Disposable Income for a Family of |

Fee Remission 學費減免 |

Fee Payable (per year) 應繳學費 (每年) |

| $0 - 368,000 | 100% | 0 |

| $368,001 - 490,650 | 80% | 20% |

| $490,651 - 613,300 | 60% | 40% |

| $613,301 - 735,950 | 40% | 60% |

| $735,951 - 858,600 | 20% | 80% |

Single Parent Relief Measure has been introduced since 2014-15. For the purpose of benchmarking disposable family income, the number of family members for single parent families will increase by 1.

To estimate how much fee remission you might receive if admitted to the school, please make use of the "Calculator".

Once a student is granted fee remission upon admission, the Council is committed to the student paying the same tuition throughout his/her schooling years at SPCC. In other words, they will not be asked to pay more even if we adjust tuition provided that the financial circumstances of their families remain more or less the same.

Application for fee remission is simple and straight forward. The Application Form and Brochure can be downloaded here; printed copies are also available for collection at the school.

Students are also eligible to apply for the Textbook Assistance Scheme and Travel Subsidy Scheme operated by the Student Financial Assistance Agency (SFAA) of the HKSAR Government. As our Fee Remission Scheme is among the most generous of its kind, families receiving the Comprehensive Social Security Assistance and those SFAA recipients are generally qualified for fee remission.

Emergency Financial Assistance

Emergency financial assistance is available to families whose financial position has changed adversely in the middle of the school year. Fee remission up to 100% will be granted to applicants subject to information submitted in support of the application.

Enquiry Hotline: 2101 0803

More about the Scheme

Benchmark Disposable Income

The benchmark disposable income will be reviewed from time to time but for the academic year commencing September 2023 will be HK$245,350 per annum for a household of up to 3 persons. If the actual number of persons in the household (defined as the parents, unmarried siblings and grandparents of the student living in the same residence for at least 6 months during the year) exceeds 3, the benchmark disposable income would be increased by HK$122,650 for each additional person (Please refer to Table 2).

Family Disposable Income

Family disposable income is defined as the total annual income of the parents from all sources (please refer to Table 1 and Table 2) as well as 40% of any income earned by other family members living in the same residence for at least 6 months during the year after deducting the cost of rental of the principal family residence or the amount of the mortgage payments (excluding any lump sum payments and additional payments in excess of scheduled monthly repayments) relating to the principal residence.

You can view or print the above documents in PDF format with Adobe Reader

Table 1: Applicant is required to report the sources of his family income as listed below:

| Items that need to be reported | Items that need not be reported |

| 1. Salary, including Provident Fund or Mandatory Provident Fund contribution 2. Double pay / Leave pay 3. Allowance (including housing / travel / meals / education / shift allowance etc.) 4. Bonus / Commission 5. Contract gratuity 6. Share option gain 7. Profit from business / investment 8. Alimony 9. Income from investments (interests from bank deposits, dividends, profit from securities trading etc.) 10. Rental income net of related mortgage interest payment 11. Monthly pension / Widow's & Children's Compensation 12. Others |

1. Old age allowance 2. Disability allowance 3. Wages in lieu of notice of dismissal 4. Severance payment / Long service payment 5. Loans 6. One-off retirement gratuity / Provident fund 7. Inheritance 8. Charity donations received 9. Comprehensive Social Security Assistance 10. Retraining allowance 11. Traffic accident / Insurance / Injury indemnity 12. Bursaries / Scholarships awarded |

Where the applicant and his/her spouse have assets (excluding the value of the family's principal residence but including other properties, net of related outstanding mortgages) in excess of HK$500,000, the amount of family income is deemed to be increased by an amount equivalent to 10% of the value of assets in excess of HK$500,000. The value of assets is defined as the sum of net positive value of each individual asset (gross asset value net of its related pledged liabilities).

The amount of family disposable income will be based on the preceding year. No adjustment to the fee remission will be made for any increase or decrease in family disposable income in respect of the academic year once the application has been approved except where material misrepresentation has been discovered.

Table 2: School Fees Payable Versus Disposable Family Income Ready Reckoner

| Fee Remission Category |

Disposable Family Income | Fee Remission (%) |

||||

| Family of 7 persons |

Family of 6 persons |

Family of 5 persons |

Family of 4 persons |

Family up to 3 persons |

||

| 5 | $1,103,901 - $1,226,550 | $981,251 - 1,103,900 | $858,601 - 981,250 | $735,951 - 858,600 | $613,301 – 735,950 | 20% |

| 4 | $981,251 - 1,103,900 | $858,601 - 981,250 | $735,951 - 858,600 | $613,301 – 735,950 | $490,651 - 613,300 | 40% |

| 3 | $858,601 - 981,250 | $735,951 - 858,600 | $613,301 – 735,950 | $490,651 - 613,300 | $368,001 - 490,650 | 60% |

| 2 | $735,951 - 858,600 | $613,301 – 735,950 | $490,651 - 613,300 | $368,001 - 490,650 | $245,351 - 368,000 | 80% |

| 1 | $0 - 735,950 | $0 - 613,300 | $0 - 490,650 | $0 - 368,000 | $0 - 245,350 | 100% |

Some Worked Examples

Example One: Family of 4 (Parents, Two Children in SPCC Secondary School and Primary School respectively)

| Items |

Actual Amount |

Calculation |

Family Disposable Income |

|

Father's salary |

680,000 per year |

Full amount included |

680,000 |

|

Self-owned flat for residence (net amount) |

3,500,000 |

Not included |

- |

|

Mortgage payment for the flat |

240,000 per year |

Deducted |

Less 240,000 |

|

|

|

Family Disposable Income in Total: |

= 440,000 |

Fee Remission for 1st child in Secondary School: 80%

Fee Remission for 2nd child in Primary School: 100%

Example Two: Family of 3 (Mother, one grandmother, one child in SPCC Primary School)

| Items |

Actual Amount |

Calculation |

Family Disposable Income |

|

Mother's salary |

380,000 per year |

Full amount included |

380,000 |

|

Rental for residence |

120,000 per year |

Deducted |

Less 120,000 |

|

|

|

Family Disposable Income in Total: |

= 260,000 |

Fee Remission for the child: 100% (i.e. Tuition Fee: HK$0)

Note: For a family of 3, benchmark disposable income is $245,350 and fee remission for the child is 80%. For single parent families, the benchmark disposable income is increased by $122,650 and additional 20% fee remission awarded. Total fee remission 100%.

Example Three : Family of 5 (Parents, two grandparents and one child in SPCC Secondary School)

| Items |

Actual Amount |

Calculation |

Family Disposable Income |

|

Father's salary |

360,000 per year |

Full amount included |

360,000 |

|

Mother's salary |

260,000 per year |

Full amount included |

260,000 |

|

Self-owned fully-paid flat for residence |

4,000,000 |

Not included |

- |

|

Fixed deposit at bank |

2,000,000 |

10% of |

150,000 |

|

Interest income from fixed deposit at 3% per year |

60,000 |

Full amount included |

60,000 |

|

|

|

Family Disposable Income in Total: |

= 830,000 |

Fee Remission for the child: 40%